Table of Contents

In the rapidly changing world of finance, cryptocurrency stands at the forefront, silently reshaping how we perceive value and conduct transactions. From its humble beginnings, this digital revolution has sparked intense debates and inspired a burgeoning ecosystem of innovative applications. As traditional systems grapple with disruption, the decentralized ethos of crypto offers a glimpse into a future where financial power is redefined and democratized.

With each technological advancement, the landscape of crypto continuously evolves, revealing new opportunities and challenges. Blockchain technology, smart contracts, and decentralized finance are not merely buzzwords; they represent a transformative shift in how we interact with money and each other. As we unlock the future of this intriguing realm, understanding its dynamics becomes essential for navigating the complexities of tomorrow’s economy.

The Rise of Decentralized Finance and Its Impact on Traditional Banking

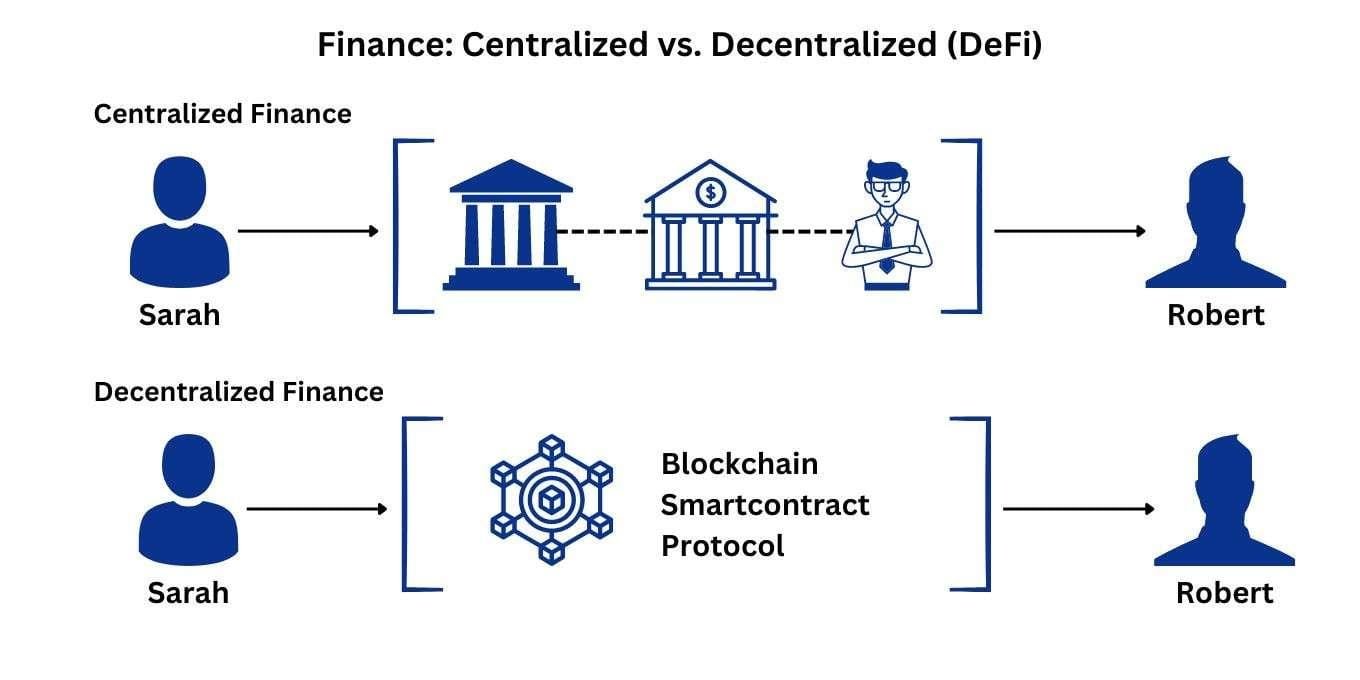

The emergence of decentralized finance (DeFi) represents a seismic shift in how financial services operate. By removing intermediaries, DeFi platforms empower users with greater autonomy over their assets. This democratization allows for seamless peer-to-peer transactions, micro-lending opportunities, and enhanced accessibility for individuals excluded from traditional banking services. As more users embrace these systems, traditional banks may find themselves facing an unprecedented challenge in relevance and customer retention.

In response, established financial institutions are beginning to explore integration with blockchain technologies, prioritizing efficiency, transparency, and cost-effectiveness. Many are investing in their own cryptocurrencies or partnering with DeFi networks to offer hybrid services that appeal to tech-savvy consumers. This blending of traditional and decentralized systems could redefine credit rating methodologies, lending processes, and even investment strategies, blurring the lines between conventional banking and innovative financial solutions.

Understanding Regulatory Developments and Their Role in Shaping the Market

The regulatory landscape surrounding cryptocurrency is continuously evolving, driven by the need for consumer protection and market integrity. As governments and financial institutions adapt to this digital revolution, they establish frameworks that aim to control the risks associated with crypto assets. These regulations, though often perceived as restrictive, can ultimately cultivate a more stable market, promoting widespread adoption and innovation.

Investors are increasingly looking for clarity and legitimacy, which regulations can provide. By doing so, authorities can help highlight key aspects of the market, including:

- Investor Protection: Safeguarding consumers from fraud and misrepresentation.

- Market Stability: Reducing volatility through oversight and compliance.

- Taxation Compliance: Ensuring proper reporting and taxation of crypto transactions.

As these frameworks develop, they will likely impact trading practices and investment strategies. Adapting to changes while remaining compliant may be challenging for participants, yet those who remain proactive will find opportunities that come from a more regulated environment.

Innovative Technologies Driving the Next Wave of Cryptocurrency

The cryptocurrency landscape is witnessing a transformation, driven by innovative technologies that enhance security, scalability, and usability. Blockchain interoperability is enabling different cryptocurrency networks to communicate seamlessly, fostering an ecosystem of interconnected digital currencies. With this evolution, decentralized finance (DeFi) is becoming increasingly sophisticated, allowing users to engage in innovative financial services without traditional financial intermediaries.

Additionally, emerging technologies like artificial intelligence and machine learning are being harnessed to improve trading algorithms, predictive analytics, and market surveillance. These advancements contribute to a safer trading environment and better decision-making processes. As these technologies continue to evolve, they will lay the groundwork for a more robust and user-friendly cryptocurrency ecosystem.

| Technology | Impact on Crypto |

|---|---|

| Blockchain Interoperability | Enables seamless communication between networks. |

| Decentralized Finance (DeFi) | Empowers users with innovative financial tools. |

| Artificial Intelligence | Enhances trading strategies and market analysis. |

Strategies for Investors: Navigating Opportunities and Risks in a Dynamic Environment

In the rapidly evolving crypto landscape, investors must stay agile and informed. Diversification is key; consider allocating assets across different sectors, such as decentralized finance, non-fungible tokens, and blockchain infrastructures. Be vigilant about market trends and technological advancements that can pivot the industry’s direction.

Risk management is equally essential. Employ strategies such as stop-loss orders and position sizing to protect your investments. Additionally, regularly review and adjust your portfolio in response to market changes. Staying updated with regulatory developments can also provide insights into potential risks and opportunities.

| Strategy | Description |

|---|---|

| Diversification | Spread investments across various crypto assets to mitigate risk. |

| Stop-Loss Orders | Set predefined sell points to limit potential losses. |

| Position Sizing | Allocate appropriate amounts to each investment based on risk tolerance. |

Key Takeaways

As we navigate the unfolding narrative of cryptocurrency, it’s essential to keep in mind the dynamic landscape that is continually shifting beneath our feet. The future of crypto holds both promise and uncertainty, and understanding these nuances is crucial for anyone looking to engage with this digital frontier.

Key considerations for the future of cryptocurrency include:

- Regulatory developments: Governments worldwide are crafting laws that will shape how crypto operates.

- Technological advancements: Innovations like blockchain and smart contracts are redefining possibilities.

- Market dynamics: The influence of traditional finance and new entrants into the market can alter the status quo.

embracing adaptability and promoting education within this space will empower individuals and institutions alike, fostering a more informed and resilient financial ecosystem. As we continue exploring how these elements interweave, let us remain vigilant, curious, and proactive in unlocking the full potential of the crypto world.